Residents of our town are voting today on three special property tax increases. They’re meant to fund some school renovations, for the most part.

When I think of our town’s budget, I think about its financial statements. So, I found the 2013 budget and some cool charts, some of which I show below.

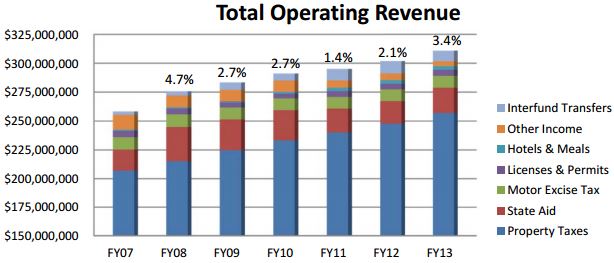

Our town’s revenues grow slowly. It’s a very built-out town, with some homes going back over 100 years. There’s simply not a lot of room to add more homes and businesses to the land.

So, the number of the town’s “customers” is fixed. The only real way to increase revenues is through price increases, mostly through higher property taxes.

There are two complications with that. First, by law in Massachusetts, property tax increases each year are capped at 2.5%. If a town wants more than that, it must be approved by voters. Hence, today’s special election.

And, since politicians cannot ask for greater increases each year, our town’s revenue growth is limited, as the chart below shows. Revenues grow slowly. If this were a stock, it would definitely be a sleepy company with a low trading multiple.

The second complication is this: the town’s profit margins are declining each year. That’s because health benefits and pension costs continue to grow very fast. And, when a mayor tries to cut pension costs or health benefits for teachers, the police force or fire department, those groups come out with a vengeance come election time to try and oust the mayor. Or, they call in fellow union members and raise a ruckus.

So, this means that operating expenses grow faster than revenue. It means a budget squeeze. And, when you suddenly have a major construction project, such as school renovations, you have to ask voters for a special tax.

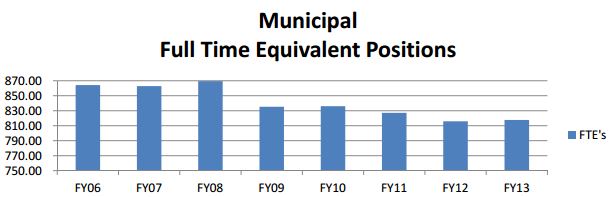

Our town mayor, though, has been pursuing spending costs, whenever possible. He has cut the biggest part of expenses: labor. The chart below shows the number of full-time equivalent people on the town payroll.

But, there’s only so much cost-cutting he can do. So, he now has to cash in some political capital and ask for a tax increase.

I think our town’s problems reflect the nation’s as a whole. Costs are rising faster than revenues. Special interests howl against spending cuts or the closing of tax loopholes. Voters themselves don’t want more taxes (but, are open to tax increases on others).

But, here’s the rub. The math only works if we have both spending cuts and tax increases. They’re both inevitable.

Dead-on! Cutting spending only won’t work.