Fred Wilson has another awesome post today about how hard it is to create real companies. He wrote:

I have said many times that early stage VC is a lot like baseball, if you get a hit one out of every three times, you are headed to the hall of fame. And if I look back over my career, and also over the track records of the firms and funds I have helped manage, that is pretty much the hit rate I have seen.

It’s a very honest post, and something we in VC know. Most of our companies do not produce great returns, and that’s true for all, including VC super-stars.

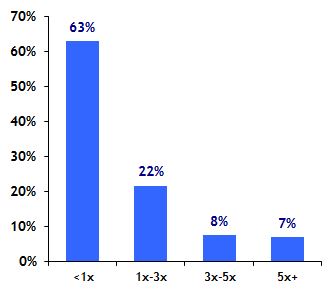

Here are sobering data from Cambridge Associates. It shows IT & digital media start-ups from 2001 to 2011 and their multiples. Yup, over 60% of them don’t return capital. They’re losses. Just 7% of companies generate >5x returns.

Fred’s comments and this data match what I’ve heard from many of our investors: the “loss ratios” for the good and bad VCs are the same. The difference between the groups is that the good ones have some super-winners.

So, VC is not about minimizing losses. It is about working with great entrepreneurs who can overcome obstacles and, in the end, create real businesses. In other words, you have to be really “go for it.” If not, your returns will suck.

Similarly, entrepreneurship is also hard. Creating real companies is usually a grind. It’s one thing to build a cool product. It’s another thing to build a real company.

There really is no free lunch.

One thought on “Venture Capital and Its 33% Success Rate”