In finance, there’s a fundamental concept called “beta.” It’s a measure of relative risk, specifically, how risky a security is vs. the rest of the market.

A beta of 1.0 means that a security has the equivalent pricing volatility of the stock market as a whole. A beta greater than 1.0 means that it is riskier than the market. So, if the market moves up or down, a “high beta” stock is going to move even more so.

We are now in a correction phase in the markets and high beta securities are getting crushed. My friends at Bessemer Venture Partners call the recent 40% decline in public SaaS stocks a “SaaS-acre,” for example. The New York Times today wrote about a “cryptocurrency meltdown.”

I find that people ignore beta when markets are up and to the right and are greatly surprised when markets are going down. Example: we’ve had an incredible bull run for about 10 years as the Federal Reserve drove interest rates after inflation (called “real” rates) below zero and as government fiscal policy transferred a great deal of stimulus money into citizens’ accounts during the pandemic. During this time, high beta securities jumped: cryptocurrencies, meme stocks, tech stocks, etc.

During this time, there was no talk about beta that I recall. People just assumed that we were on a new tech wave that was going to create prosperity for a while. Instead, perhaps, it was just a good time to be in high beta securities?

Now that we are in a correction phase, entrepreneurs are laying off workers in droves. After subsidizing rides for years, at Uber there’s a new-found belief in free cash flow.

What’s happened?

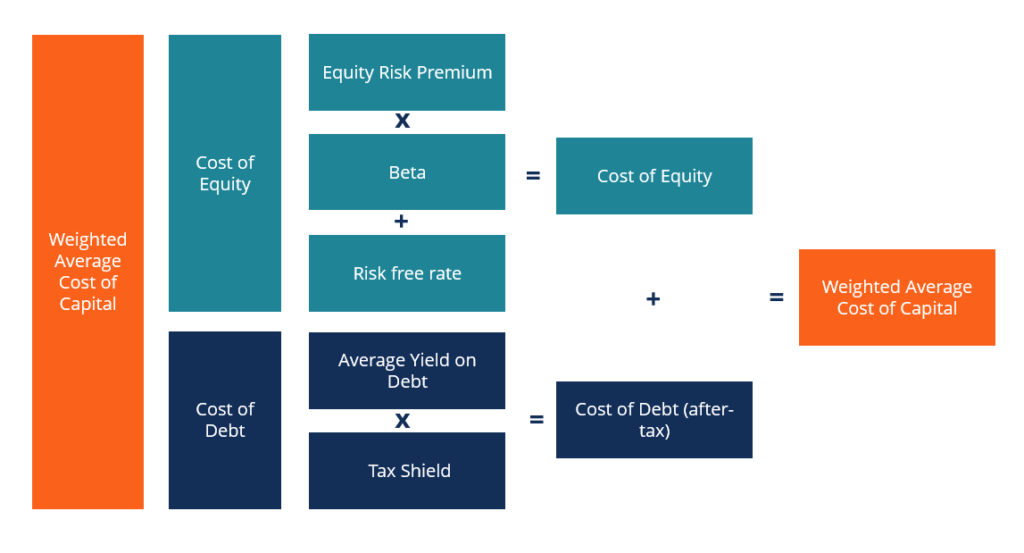

Implicitly, the cost of capital has gone up. The Fed is raising rates and the price of money has gone up in the economy, leading to fewer transactions. (Read more about the “weighted average cost of capital” here.; or look at the chart below–the Fed’s actions have increased the cost of debt and the “risk-free rate.”)

Has beta gone up too? I doubt it. Nothing is really “broken” in the economy. We are just in a phase when the Fed is trying to cool things down as inflation increases, and as we fight “stagflation,” a period involving both slow/negative GDP growth and high inflation. It will be a tricky balance for the Fed.

What’s next?

Keep an eye on the “yield curve“: if and when short-term rates are higher than long-term rates, we’re usually headed into a recession. And, keep an eye on VIX, a security that measured anticipated future stock market volatility. It’s pretty high right now. Public and private investors used to be in a risk-gathering mode; they’re now in a risk-shedding one.

There really is no free lunch in the capital markets, at least for very long. Crypto is getting crushed because it inherently is high beta. Unfortunately, my fear is that loads of people bought into the hype, not knowing what they were getting into.