Fred Wilson wrote a few weeks ago about how he invests his money (more here). I thought I would do the same.

A huge chunk of our net worth is tied up in the Kepha funds.

For the rest, I follow the Yale endowment model, but adjusted for retail investors. Specifically I follow the recommendations of David Swensen the person who heads the endowment.

I had him as a professor in college. I’m sure he won’t remember me. I have read two of his books. One of them offers financial advice for the everyday investor (click here).

Basically, he argues that the individual investor cannot duplicate what the Yale endowment has done. You simply don’t have the sophistication or access to certain managers. So, he recommends that people invest in index funds. He also offers a particular asset allocation approach (click here for a good article on him and his recommendations).

His approach is meant to give both upside and downside protection. He recommends cheap index funds, as active mutual funds do not beat the market over time when adjusted for fees. Every quarter, you rebalance to get to the same percentages. This forces you to sell the asset classes going up and buy the ones going down. So, buy low, sell high.

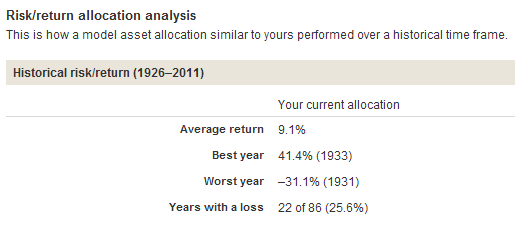

I’ve been following this approach for a few years. Overall, I’ve been very happy. It isn’t without risk, but the expected long term annual return is 9 pct, as shown below.

I have enough going on with my life and so this has been an easy way to manage our retirement funds.

Great post, Jo. What were your best and worst returns for a year following that model?

9.1% looks pretty awesome!

Dave, great to hear from you.

I was crushed in the 2008 crash like everyone else, but interestingly, the Treasury bonds rallied huge (about 20%). So, part of the model is that you invest in Treasuries to protect you from calamity.

Since then, the portfolio has done very well. REITs and Emerging Markets did very well last year. This year, surprisingly, the US market has been strong.

So, some ups and downs, but I’ll take 9% any day!