Well, Microsoft is spending $7 billion to buy Nokia. As I tweeted when it was announced:

I’m so old that I remember when Nokia phones were HOT.

— Jo Tango (@jtangoVC) September 3, 2013

But, seriously, I’ve been reading some articles and blog posts about why or why not this was a good idea. Stockholders clearly thought it was not, since Microsoft’s stock price declined when the deal was announced.

Here are my 2 cents. I don’t think the deal matters much.

Here’s why: Microsoft’s Office and operating systems dominate the company’s results, and everything else is almost inconsequential.

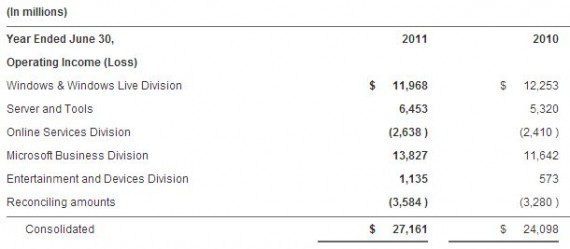

Below is a chart of the company’s operating income broken out by business unit, which I screen-captured from the company’s web site. It shows that Windows and Office (called “Business Division”) are nearly all of the company’s profit. Everything else is too small to move the needle.

So, what happens to Microsoft? Well, the company has $70 billion+ of cash and generated last year $24 billion of operating cash flow. The company has “long legs.” But, it’s not growing much as the Windows and Office businesses are largely mature.

Ultimately, it’s up to the board: do they reinvest excess cash in new businesses to try to generate growth? Or, do they just return the cash to investors through dividends?

There are good arguments for both. I don’t own MSFT stock, but if I did, I’d prefer the cash. The track record is pretty poor for companies trying to re-invent themselves when core businesses mature.

It’s tough to pivot when you’re an elephant.