I’ve written in the past about the commoditizing banking system. I mean, who really goes to a retail bank location anymore for most day-to-day needs? You can get cash at an ATM or “cash back” via debit card at the grocery store. You can deposit checks via a phone app.

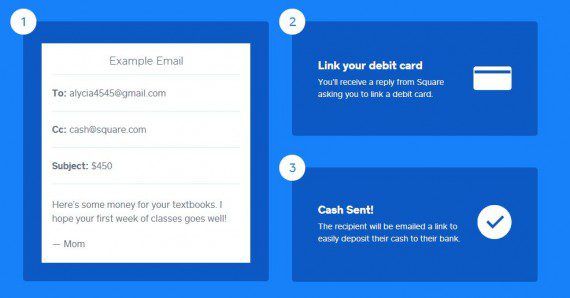

I think yesterday marks a dramatic development: Square announced a free service to let you send payments via email. You don’t sign up for a service, you just send an email per the graphic below on their web site:

Some technology innovations take time, but gradually, they happen and become inevitable. Price points collapse, friction is removed and a whole new digital system takes over. It happened in music (iTunes, Napster, etc.), radio (Pandora, Spotify), flea markets (eBay), commerce (Amazon), and it’s now happening in banking.

Very cool.

Hi Jo. This is super cool, but arguably not at all new. Paypal has offered the rough equivelent for many years. Patent on this was issued in 1994. Here’s all the details:

http://www.quora.com/Square-Cash/How-does-Square-Cash-work-technically/answers/3344470

Of note: Looks like Square is paying $0.10 per email/money transfer. Of course the long term assumption is some day Square charges fee, rather than paying fee. But meantime, that is one super capital-intensive startup. Would you fund that at early stage?

Btw, its the same story with Square’s core business — they are subsidizing merchant fee transaction processing fees at huge expense to themselves, to wage a price war with incumbent transaction processing platforms. Not really a technology innovation play, more of a massive tonage of capital play?

Hi Steve, thanks for the thoughtful comments. I think you’re right.

Some start-ups are absorbing transfer or interchange fees to essentially “buy” their way into the market. Amazon did this in e-commerce for a long time, making money on gross margin but not breaking even on net income; they pursued scale and eventually developed favorable AR/AP terms so that they are now operating cash flow positive and did so by cutting great terms with vendors. It can work. But, it takes a lot of money.

We’re not investors in Square and nor am I vouching for their business strategy. But, as a consumer, I love that Square isn’t charging me for inter-party payments. I love that this price umbrella is collapsing, and you’re seeing it in more parts of the economy, whether B2C (OTT vidoe like a Netflix vs. cable channels) or B2B (open source software in certain categories). I think these price wars are interesting to watch.