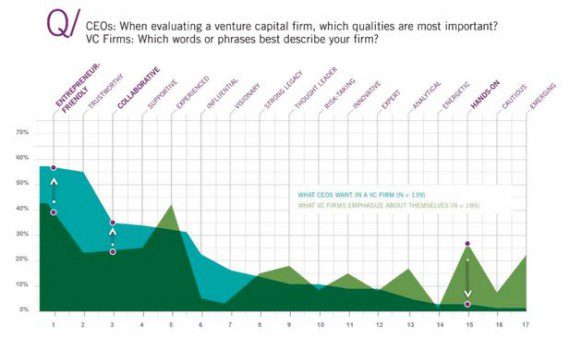

There’s an awesome survey that just came out. Sponsored by the National Venture Capital Association, it asked both VCs and entrepreneurs what they think is valuable about venture capital. For me, what struck me were the following charts.

First, what entrepreneurs perceive as “value” from a VC firm can be very different from VCs’s opinions:

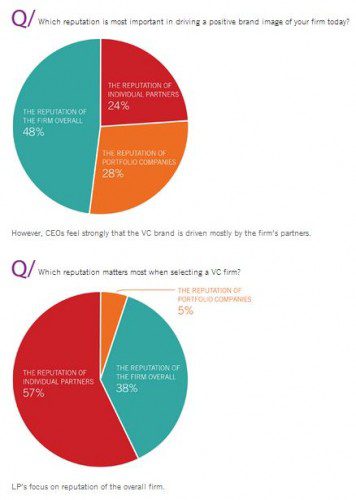

Second, entrepreneurs care more about an individual GP’s brand vs. the brand of a firm:

The gap highlighted in the first point doesn’t surprise me. There’s usually a gap between a buyer and a seller.

The point raised in the second chart makes sense to me, in that the person sitting on your board, who is either helping or hindering, is an individual. An entire VC firm isn’t going to your board meetings.

I’ve written in the past that, IMO, early-stage VC does not scale and is instead a “service provider” business. In fact, I don’t think of it is an “industry” and instead think of it as a “craft business.” If your greatest asset isn’t a firm-wide brand and is instead the various individuals, then your best assets walk out the door each day. Or, they can quit, switch firms, retire, etc.

In general, services businesses are difficult to scale. In fact, many VCs will not invest in such a business precisely because of concerns about scalability. It’s one reason why my partners and I believe in a small, focused and nimble firm. We don’t invest in services businesses, and so, wouldn’t it be ironic if we tried to “scale” our own?