Geez. Where is the floor? #svb at $60 one hour ago pic.twitter.com/6qOBTu2BSW

— Jo Tango (@jtangoVC) March 10, 2023

SVB.

The collapse of Silicon Valley Bank is something I am still processing, honestly. I know many good people at the bank and, a long time ago, served on one of their Advisory Boards.

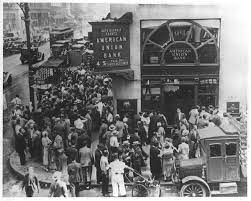

It was the Prisoner’s Dilemma in action. We were in a self-fulfilling prophecy as people withdrew their funds. You can use this Expected Value Calculator. Let’s say you had $100,000 at SVB and the odds of insolvency were 1%. If they don’t default, you still have your $100,000. If they do, you’re out $100,000. Even with 1%/99% probabilities, you’re better off transferring money out as a precautionary measure. If and when things calmed down, you could always wire back the money.

That’s what the math says.

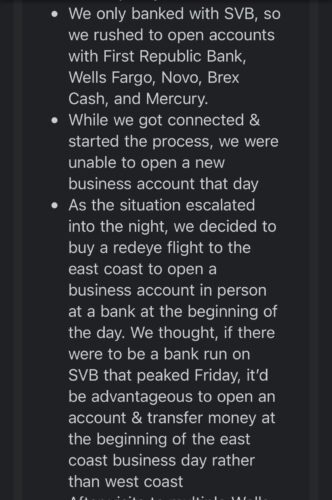

But the human element is where I’d like to go to next. It was incredibly taxing. Here is what the founders at one of our angel investment companies had to do:

Eric was up until late Thursday night to plot next steps, and I was up at 3:30 am on Friday. We contacted all of our companies to assess our exposure level, and we wrote our LP Advisory Boards on Friday night.

Then, we waited.

It was unclear if the US government was going to intervene, let alone when and how. I spent a lot of the weekend doom-scrolling until I realized there was nothing more I could do.

In a way, I felt helpless. Yet, it was liberating to know the future was out of my control. I felt the same way during the 2000 Dot Com Meltdown and in the weeks after 9/11. I felt the same way when I was 33 and my mother died and, a few years later, when my BIL died overnight, leaving behind a financial mess.

The good news is that Eric and I are a very good team. Our shared values help us to align and work together. And, the ability to block out noise and focus is something you develop as a VC, or the industry expels you. Since 70% of VC-backed companies do not return capital, most of our days are spent dealing with failed missions and the occasional outright car wrecks. You get used to the volatility. As I tell my students, one of the good things to come from a traumatic childhood is my ability to live through upheaval and keep a clear head. My emotions come out later once the crisis has passed.

With SVB now in receivership, it’s a done deal as we all withdraw our money. There’s a massive capital shift going on I suspect, away from regional banks to the Big 4. That’s a shame, but those are the incentives the US banking system has put in place and which is quite clear now. There is minimal insurance for commercial accounts, which trend well above the FDIC maximum insurance level.

Friends and colleagues have been asking me how I’m doing.

Honestly, I’m feeling pretty numb. My day today is filled with filling out new-account applications at another bank and assembling the required paperwork. I’m relishing the monotony of those tasks given all that has happened!

A friend sent me this as I rekindle my gratitude:

To the SVB team: thank you for all you did for so many. I hope someone buys the assets and keeps the team together. I wish you all peace!