One of the benefits of being older (and, on some days, feeling old) is that I’ve seen a few market cycles: the 1987 crash, the first Gulf War in 1990, the dot-com bubble and crash, 9/11, and the 2008 Great Recession.

When these market dislocations happen, I get concerned. But, I don’t panic. Financially, I get prepared to lean into market selling. As Warren Buffet says: “Be greedy when others are fearful, be fearful when others are greedy.” In 2009, this was fortuitous.

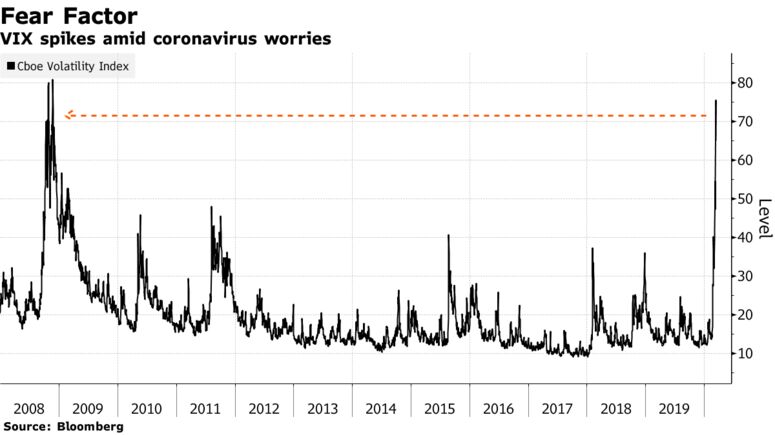

After the markets collapsed in 2008, I kept an eye on “the fear gauge.” Known as VIX, you can buy this security, which anticipates volatility. When a crisis erupts, VIX soars.

Specifically, VIX measures the consensus 30-day forward opinion of the market’s volatility. A VIX of, say, 15 means the market expects with 68% probability (or, one standard deviation for stats fans) that the market will go up or down 15% in the next month.

Yesterday, VIX closed at a whopping 65. The all-time high is 79.

When the markets collapsed in 2008 and into 2009, I kept an eye on VIX. At one point, it started to drop significantly, and I noticed that equity markets started to rally. So, I re-balanced my portfolio (my investment strategy here), selling bond index funds and buying equity index funds. Also, I invested in some 529s for my children’s college funds.

It turned out, luckily, to be a good move. I missed the market low by just two weeks, and markets started an 11-year rally. For every dollar I put into my kids’ college funds, I’m now at $2.50.

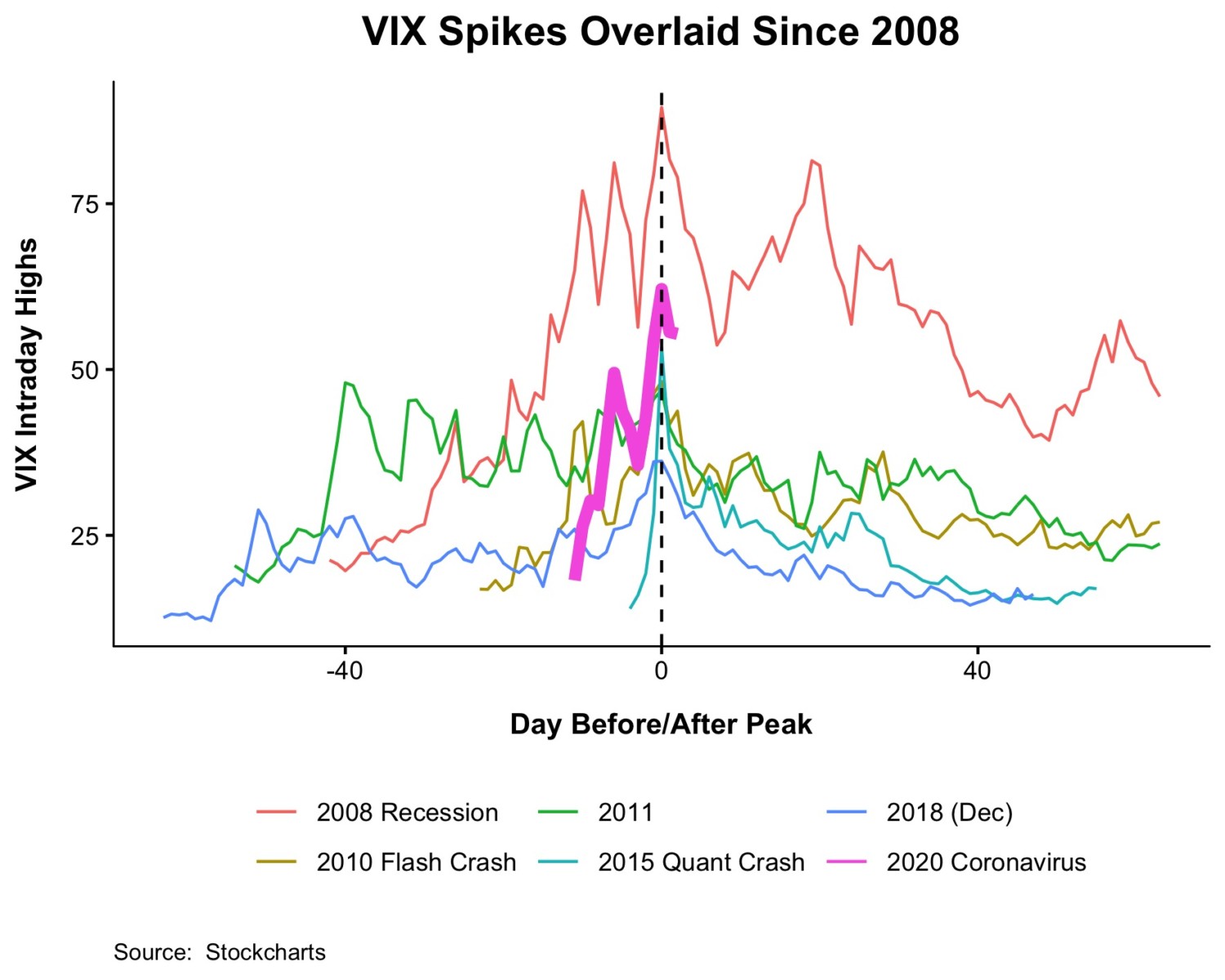

Here’s an interesting chart that shows how VIX reacts during financial crises, including the current one.

So, keep an eye on VIX, and rebalance when you feel the markets are calming down.

Why do I write about this during a pandemic? It’s a pretty stressful time right now, with schools closing, store shelves emptying, and markets falling. But, I try to choose to see the bright side of things. And, this is one way for me.

The second way has been through puns.

Amazingly, even with #Covid19, Disney is still open! I think they should change the characters:

. Snow Blight and the Seven SARS

. Mickey Louse

. Peter Pan(demic)

. Beauty and V.D.

Other suggestions?#WaltDisneyWorld #Disneyland

— Jo Tango (@jtangoVC) March 11, 2020

Finally, yesterday, I had a gyro with fries in it. Totally epic.

Stay safe, everyone….

Jo,

Have you purchased any securities during the past few weeks? Where do you think this market is going…

I rebalanced towards equities March 25. I like the market long term, but we currently are in uncharted territory. It will take years for GDP growth to come back, as we are dependent on a vaccine.

I can appreciate that but according to recent media reports a vaccine may or may not be in the works. What if a vaccine isn’t forthcoming? The economy can’t be at a standstill forever. I don’t say that curtly but a lot of people are feeling the pain of not being to work.

There are multiple trials underway. When one is found, manufactured at scale and distributed are the unknowns.