Through my VC work, research at HBS, and our family’s angel investing program, we get a lot of updates from many entrepreneurs in many sectors. What I concluded last month is this: it is game on with the economy.

Various founders report that their sales cycles have accelerated, and this cuts across multiple sectors: digital advertising, manufacturing, infrastructure software, etc.

A part of me feels this is rational. People have money from stimulus checks and are feeling more optimistic as the vaccines roll out. A part of me fears this. Public multiples are at crazy high-levels (they’re higher than they were pre-Covid). Friends in venture capital and private equity all report that things are absolutely nuts in terms of investment pace and exits. Many millennials and Gen-Z folks have discovered stock trading and are investing based on crowd sentiment, not on the fundamentals.

I worry. I lived through the 1998-2002 Dot-Com Bubble and Crash as a VC. The more robust the party, the worst the hangover will be. The more taut a rubber band is pulled, the more violent the backlash.

All this puts investment managers in a quandary. Do you slow down? Do you pass on high valuations and sit on the sidelines? The challenge is that you don’t know when the party will end and, if your competitors are benefiting from a frothy market, you have to play the game too.

I’m not smart enough to time the markets, but here is what I believe:

- The USA will lead the world out of the global recession. We have a huge GDP and are ahead of most large countries on rolling out the vaccines.

- Consumer spending is 2/3 of our GDP and people are sitting on serious cash. Enough consumers have spent less during the pandemic and the multiple stimulus checks are a real force.

- The $1.9 trillion infrastructure bill will only add to aggregate demand.

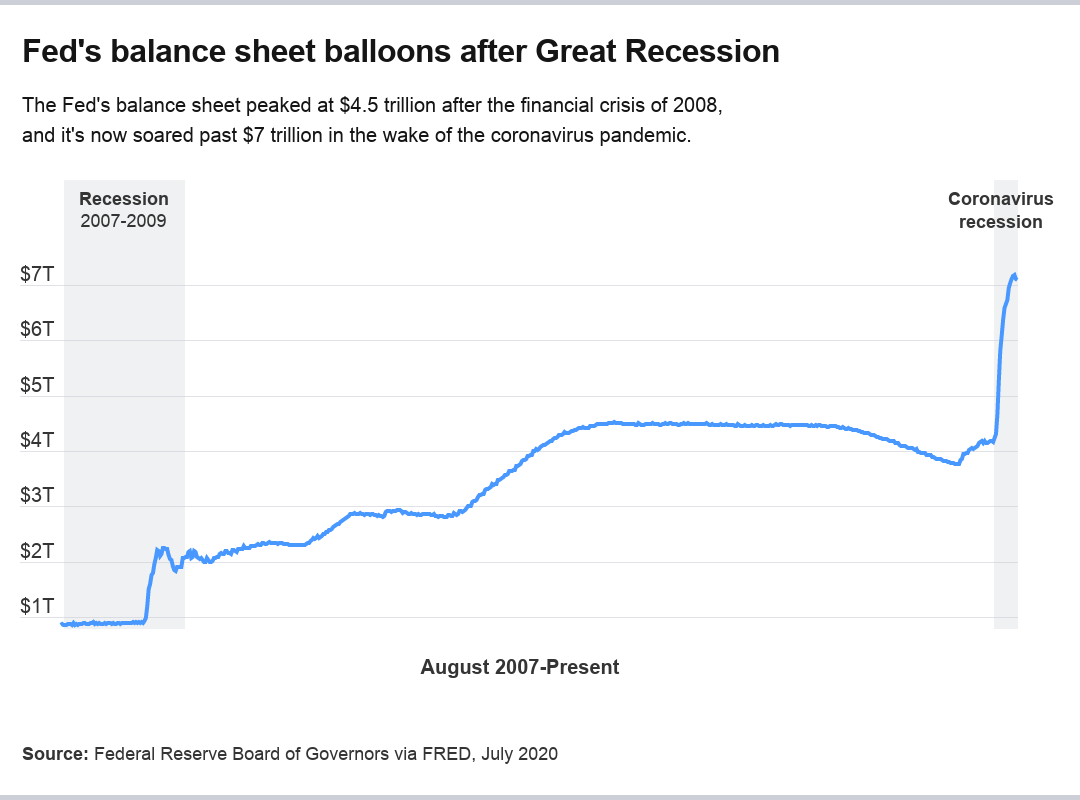

- The Federal Reserve is extremely accommodating. The 10-year Treasury yield, to which mortgage rates are tied, as of today is 1.5%; that is crazy low. And, to boost asset prices and inject cash, the Fed has been buying securities in crazy amounts. See the photo below.

There’s a chance that inflation explodes. I think it is minimal as unemployment is still high and capacity utilization is low. So I predict The Roaring ’20s.

Hold on tight folks. This will be a wild ride!